On or after the 27th of February 2014 for California, Pennsylvania, and Texas residents.On or after the 27th of February 2015 for those living in the states of Alaska, Colorado, Delaware, Maryland, Mississippi, New Hampshire, North Carolina, and South Carolina.

The abovementioned Class groups have different Class Period information for each participant residing in different states. The Statutory Class includes car loan borrowers who entered into loan agreements bundled with GAP insurance with Wells Fargo that were subjected to the law and did not receive any insurance refund at the early end of their car loan terms additionally, individuals who Wells Fargo was not notified of receiving any GAP refund is covered under the Statutory Class group.The Class group includes car loan borrowers whose loan terms ended earlier than what was agreed upon, and GAP agreements were with Wells Fargo and did not receive any insurance refund at the conclusion of their car loans.This settlement case will cover two Class groups as approved by the court: Listed below are some of the key details one should know to be abreast of the latest developments in the Wells Fargo GAP Insurance Settlement. Wells Fargo GAP Insurance Class Action Settlement Agreement’s Key Details Yet this is a far cry from the $500 million total settlement fund aimed to be divided amongst claimants. Reports suggest that the bank is already able to pay out countless qualified Class members that amounted to above $33 million.

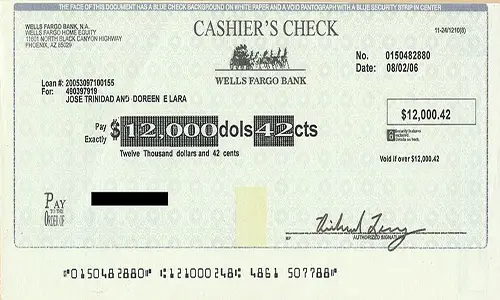

To date, the court hearing the class action has not rendered any decision in favor of neither the plaintiff nor the defendant.Īs of writing, it is reported that Wells Fargo has already been able to distribute a fraction of the settlement fund to eligible claimants. However, they vehemently denied any misdeeds on their end. Wells Fargo ended up agreeing to select conditions set upon by the settlement agreement presented to them. It is a type of insurance that car loan borrowers are required to pay the moment they will buy a new car after their car loans are granted by a financing institution such as a bank.Īlthough a loan holder can get their GAP insurance back if they were able to finish their loan earlier than the first agreed-upon term, Wells Fargo allegedly did not refund its car loan borrowers of their GAP insurance. It is worth noting that Wells Fargo has agreed to shell out $500 million as the main settlement fund to end the Wells Fargo GAP Insurance Class Action Lawsuit litigation process.įiled by plaintiff Armando Herrera and others in a California federal court, the aforementioned class action centered upon the claims that Wells Fargo did not pay back their car loan borrowers’ GAP or guaranteed auto protection insurance. Wells Fargo GAP Insurance Class Action RevisitedĬlick to access Armando-Herrera-et-al.-v.-Wells-Fargo-Bank.pdf v. Wells Fargo GAP Insurance Settlement case take heed! The settlement details have been released recently on several outlets online, and we here at Consider The Consumer are more than happy to provide you with the key information to know about. Class Action Settlements Armando Herrera Settlement 2021 – Wells Fargo To Settle GAP Insurance Class Action Lawsuit For $500 Million…īy Consider The Consumer on Wells Fargo Gap Insurance Settlement Update: Class Action Brief, Class Group Information, And More Information ReleasedĬlaimants in the Armando Herrera et al.

0 kommentar(er)

0 kommentar(er)